iowa transfer tax calculator

Click anywhere outside that box or press the Tab Key for the result. Monroe County Iowa - Real Estate Transfer Tax Calculator.

Calculate Your Transfer Fee Credit Iowa Tax And Tags

With this calculator you may calculate real estate transfer tax by entering the total amount paid for the property.

. To view the Revenue Tax Calculator click here. Amount of transfer tax paid divided by rate per 500 A Step 2. Do not type commas or dollar signs into number fields.

What is Transfer Tax. Adopted and Filed Rules. Iowa Real Estate Transfer Tax Calculation This calculation is based on a 160 tax per thousand and the first 500 is exempt.

Tax Credits. Total Amount Paid Rounded Up to Nearest 500 Increment. Transfer Tax Calculator Returns either Total Amount Paid or Amount Due.

Type your numeric value in either the Total Amount Paid or Amount Due boxes. The tax is imposed on the total amount paid for the property. Learn About Property Tax.

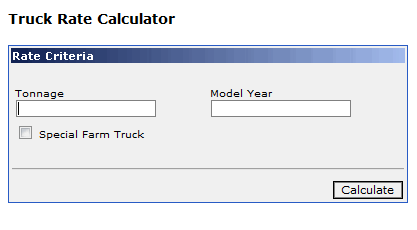

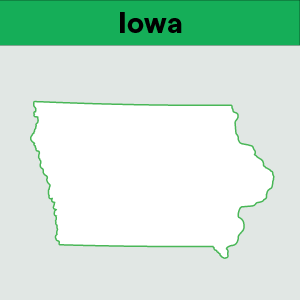

You can also find the total amount paid by entering the revenue tax stamp paid. Real Estate Transfer Tax Calculator. The Iowa DOT fee calculator is NOT compatible with Mobile Devices smart phones.

Transfer Tax Calculator Returns either Total Amount Paid or Amount Due. You can also find the total amount paid by entering the revenue tax stamp paid. Multiply A by 500 B Step 3.

For example on a 500000 home a first-time home buyer would have to pay 400000 75 100000 2 3200 in transfer taxes. This calculation is based on 160 per thousand and the first 500 is exempt. This calculation is based on 160 per thousand and the first 500 is exempt.

Learn About Sales. Transfer Tax Calculator Returns either Total Amount Paid or Amount Due. Calculating Selling Price of Real Estate Transfer Tax Iowa Real Estate Transfer Tax Rates.

You can also find the total amount paid by entering the revenue tax stamp paid. Tax Rate The calculation is based on 160 per thousand with the first 500 being exempt. You can also find the total amount paid by entering the revenue tax stamp paid.

Calculate the real estate transfer tax by entering the total amount paid for the property. For the Iowa Real Estate Tax tables Groundwater Hazard Statement Instruction s. Iowa Real Estate Transfer Tax Calculation This calculation is based on a 160 tax per thousand and the first 500 is exempt.

Tax Calculator Iowa Real Estate Transfer Tax Calculator Transfer Tax 711991 thru the Present This calculation is based on 160 per thousand and the first 500 is exempt. Law. Total Amount Paid Rounded Up to Nearest 500 Increment.

This calculation is based on 160 per thousand and the first 500 is exempt. Click anywhere outside that box or press the Tab Key for the result. Total Amount Paid Rounded Up to Nearest 500 Increment Exemption - Taxable Amount Tax Rate.

You can also find the total amount paid by entering the revenue tax stamp paid. Iowa Real Estate Tax tables Real Estate Transfer Declaration of Value and Instructions Recorders services Genealogy Information. Transfer Tax Calculator Calculate the real estate transfer tax by entering the total amount paid for the property.

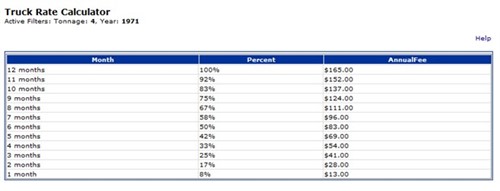

Click on Tools then Dealer Inquiry There are five options to choose from. Credit Calculator determines registration fees remaining Fee Estimator determines. Real Estate Transfer Tax Calculator You may calculate real estate transfer tax by entering the total amount paid for the property this calculation is based on 160 per thousand and the first 500 is exempt.

This calculation is based on 160 per thousand and the first 500 is exempt. Calculate Your Transfer FeeCredit. Transfer Tax Calculator Calculate the real estate transfer tax by entering the total amount paid for the property.

You can also find the total amount paid by entering the revenue tax stamp paid. Transfer Tax Calculator Returns either Total Amount Paid or Amount Due. This calculation is based on 160 per thousand and the first 500 is exempt.

Transfer Tax Calculator Returns either Total Amount Paid or Amount Due. The tax is paid to the county recorder in the county where the real property is located. Do not type commas or dollar signs into number fields.

This calculation is based on 160 per thousand and the first 500 is exempt. Transfer Tax Calculator Calculate the real estate transfer tax by entering the total amount paid for the property. Do not type commas or dollar signs into number fields.

Amount Due If you know the amount of Transfer Tax Paid and want to determine the estimated sale price enter the total tax. On any amount above 400000 you would have to pay the full 2. Enter the amount paid in the top box the rest will autopopulate.

Transfer Tax Calculator Calculate the real estate transfer tax by entering the total amount paid for the property. Calculate the real estate transfer tax by entering the total amount paid for the property. This calculation is based on 160 per thousand and the first 50000 is exempt.

As a first-time home buyer you would only have to pay a 75 transfer tax for a home price of up to 400000. - Dallas County Iowa Courthouse 801 Court Street Rm 203 PO Box 38 Adel IA 50003 Phone. Iowa Real Estate Transfer Tax Calculator Calculate real estate transfer tax by entering the total amount paid for the property or find the total amount paid by entering in the revenue tax stamp paid.

Real Estate Transfer Tax Calculator Type your numeric value in the appropriate boxes then click anywhere outside that box or press the Tab Key for the total amount due. This calculation is based on 160 per thousand and the first 500 is exempt. Type your numeric value in either the Total Amount Paid or Amount Due boxes.

Total Amount Paid Must be 99999999 Rounded Up to Nearest 500 Increment - Exemption. Press TAB for results. From To Rate June 21 1932 June 30 1940 50 per 500 July 1 1940 June 30 1991 55 per 500 July 1 1991 Present 80 per 500 Step 1.

At the top of the page is the menu. Transfer Tax Calculator Iowa Real Estate Transfer Tax Description The tax is imposed on the total amount paid for the property. Type your numeric value in the Total Amount Paid field to calculate the total amount due.

Transfer Tax Calculator Returns either Total Amount Paid or Amount Due. Rounded Up to Nearest 500 Increment Taxable Amount. Transfer Tax Calculator Returns either Total Amount Paid or Amount Due.

Iowa Real Estate Transfer Tax Calculator Enter the total amount paid. This calculation is based on 160 per thousand and the first 500 is exempt. File a W-2 or 1099.

Total Amount Paid Do not type commas or dollar signs.

Stock Yield Calculator In 2022 Slide Rule Math Stock Exchange

Delaware County Iowa Real Estate Transfer Tax Calculator

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Now That Tax Change Is More Real What Should You Do Chase Com

Endow Iowa Tax Credit Community Foundation Of Johnson County

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Iowa Sales Tax Guide And Calculator 2022 Taxjar

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Real Estate Documents Cedar County Iowa

Car Tax By State Usa Manual Car Sales Tax Calculator

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Community And Economic Development Iowa League

2022 Capital Gains Tax Rates By State Smartasset

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Ipers Vs Tiaa What S The Best Iowa Retirement Option

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management